How To Deal With Bad Credit score”—or No Credit—when You Need To Purchase A Residence

The editorial content material on this page isn’t offered by any financial establishment and has not been reviewed, accepted or otherwise endorsed by any of these entities. However, beware: Unscrupulous sellers may make the most of dangerous-credit score prospects with shady techniques together with leading you to imagine your credit score is even worse than it is or requiring you to buy add-ons as a way to get financing. Unhealthy credit personal loans usually are not one of the simplest ways to get money for something less important, like a new TV.

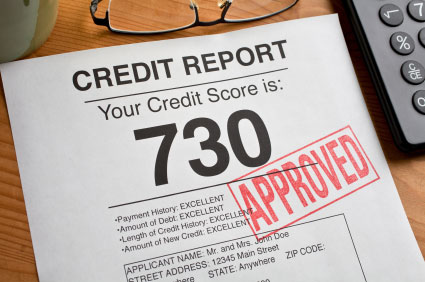

In case you are presently in chapter, chances are high low that you’ll qualify for a loan. Generally, longer terms will translate into decrease monthly payments, and a more inexpensive mortgage that borrowers will have the ability to repay. When you repay an installment loan with a lender who studies funds to the credit bureaus, you’ll be able to truly improve your credit rating over time!

If in case you have dangerous credit, then you are seemingly all too aware of the frustrations a low credit score score can bring. Private installment loans come with longer phrases, decrease rates, and—unlike predatory payday and title loans—are designed to be …