Why Credit score Administration Sometimes Needs Debt Administration

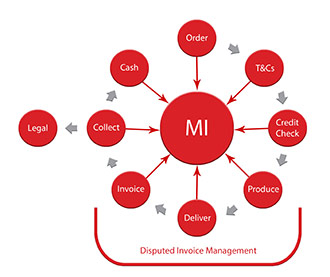

In right this moment’s capital intensive commodity on market demand and management solutions on various job resembling Portfolio management, Efficiency measurement and other refined marketing statistic, corporations face a dilemma of discovering an integrated answer to every complicated portfolio. Midstate CreditCollect’s discipline providers may be employed individually, or as part of our total debt restoration service. The financial Pundits of the banking sector have mentioned diverse vary of subjects and issues, and have arrived on 4 major themes for a better credit threat administration.

Some credit debt management counseling corporations even have interactive financial education instruments for the general public (not simply its members), for teachers, and for professionals within the monetary management industry. Efficient credit score management is about creating consistency in your credit and assortment processes.

When a provider does not cease its credit management action as requested, the Ombudsman or Deputy Ombudsman may make a temporary ruling about the provider’s credit score administration motion. Automate the Complete Credit score Cycle—Oracle Credit score Management allows you to efficiently promote monetary stability inside your enterprise by automating credit score account evaluation occasions.

Totally certified and educated credit score controllers and credit score manager are in demand by all businesses …