The Cheaper Various?

First off, I highly recommend credit unions when in any respect doable, just because they’re run by those that have your best pursuits at heart-your fellow members. Additionally the one individual to deposit money into the account would be the member of the bank. I may log on and see my current account exercise, or transfer funds to another credit score union account, however might do little else. A credit score union is a profit sharing, financial co-operative run democratically by the members of the union itself.

Credit score unions are owned by the people who use their companies, and not by exterior shareholders or investors. Credit score unions and banks are all different, meaning a financial institution can differ from one other by way of their rates of interest and the identical goes for credit unions.

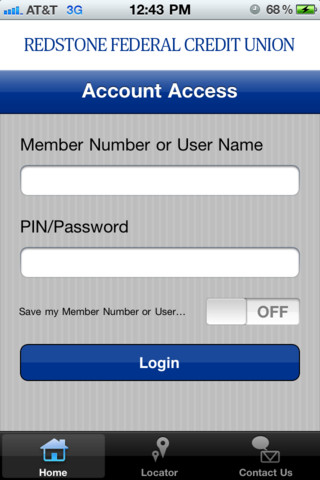

Many credit unions now have an internet site, with an growing quantity now also providing on-line software companies for mortgage and financial savings accounts, plus on-line banking and account administration services via websites and cellular apps.

Charges may fluctuate depending on each borrower’s credit history and underwriting factors. When you open an account with a credit union you routinely turn into a member. …