CRIF Credit Administration Platform

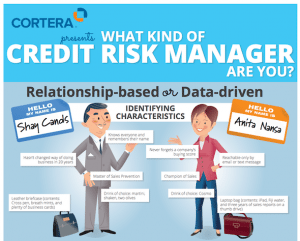

Credit score Administration Company (CMC) is a safe and totally-compliant agency made up of expert and skilled teams. These steps are fundamental to developing a good credit historical past that establishes your credibility with monetary institutions and credit reporting businesses. At NCML, we’re assured in our individuals, systems and processes to deliver the outcomes anticipated from a secondary referral agent.

We are captivated with what we do: help our clients obtain leads to credit management. Bank deposit, treasury administration and lending services and products, and funding and wealth administration, and fiduciary providers are provided by PNC Bank, Nationwide Affiliation, a wholly-owned subsidiary of PNC and Member FDIC.

In right here the banks take credit decisions by increased expert judgment, using quantitative, model-primarily based strategies. The evaluation of credit danger was limited to critiques of individual loans, which the banks kept of their books to maturity.

If you’re late and are unable to get caught up with funds by yourself, then you must ask a professional credit counselor the way to re-age your accounts. Our greatest move was switching over to UCM (Unik Credit Management) for our assortment providers.

Most credit score debt administration-counseling corporations additionally provide comprehensive debt administration services …