Financial Analyst Profession Choices

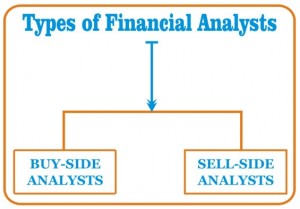

A financial analyst gathers and interprets data about securities, corporations, corporate strategies, economies, or financial markets Financial analysts are sometimes known as securities analysts , equity analysts , or investment analysts (although there’s a distinction amongst these titles). Reporting analysts educate the general public and industry insiders alike through publications just like the New York Times, Bloomberg Businessweek and the Wall Avenue Journal. For senior analysts who proceed to search for profession advancement, there may be the potential to grow to be a portfolio manager, a partner in an investment bank or senior management in a retail bank or an insurance company.

Ratings Analysts consider the flexibility of firms or governments to pay their money owed, together with bonds. An understanding of statistics, economics, and enterprise is essential, and knowledge of accounting insurance policies and procedures, company budgeting, and financial evaluation strategies is advisable.

Whereas financial planners help people develop an general monetary plan, someone has to investigate funding options and supply information about investments to planners and their shoppers. While you can choose to work as a monetary analyst with only an undergraduate diploma, those holding an MBA will many a occasions, will end in higher pay than those …