Credit score Management Vs Cash Administration

Credit Administration (Law) Ltd (CML Ltd) has developed a specialist training programme in affiliation with the Institute of Credit Administration and the Bar Council to allow credit controllers, charges recovery clerks, accounts managers and anybody else responsible for the administration of credit score and cash-stream administration in a authorized sector enterprise, to work in direction of an internationally recognised professional qualification utilizing materials related to their working environment. He would educate you in monetary administration and associated aspects similar to creating a finances and living within it, developing better spending methods, learning saving, budgeting and checkbook management as well as smart use of credit score. Handle your customer’s payment higher with Experian’s ledger supervisor device ; it will possibly help enhance your collection course of by taking your gross sales ledger data and combining it with our credit information.

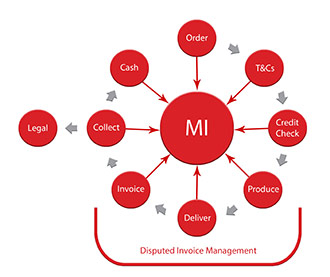

It automates portfolio management and enhance efficiency and revenue optimization. Also think about factoring (CRF Credit Assistant – Collateralization / Securitization) or commerce credit score insurance, and, after all, perfecting a security interest in your customer’s property.

Credit managers working within the United Kingdom can obtain accreditation from the Institute of Credit Management , referred to as the Chartered Institute of …