Credit score Union Or Financial institution

The usual technique of acquiring credit score has develop into so widespread that being at the mercy of accelerating rates of interest and inflated costs on loans and credit cards has develop into so commonplace that it’s straightforward to imagine there isn’t a other possibility. Credit score unions are much like conventional banks in the sense that each institutions supply financial merchandise to prospects. Because of this ownership construction, potential members have to fulfill membership necessities that vary depending on the credit union’s objective.

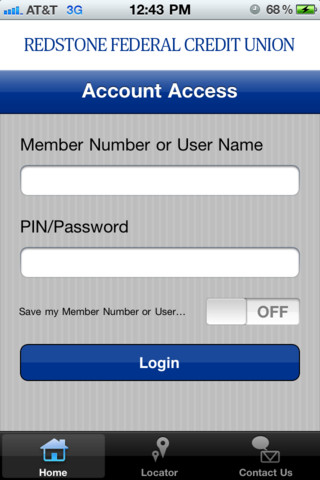

Credit Unions serve those which are usually locked out of the normal banking system. However credit unions might not work for somebody who desires specialized monetary products and advanced online services, or who needs their monetary establishment to have multiple or national locations.

Though each credit union (as all mutual societies) should make sure that enough cash is put aside to make sure monetary stability, all different earnings are used to offer the bottom interest rates for members’ loans while returning a gorgeous rate of interest for its savers.

The Nationwide Credit score Union Insurance Fund (NCUSIF) is backed by the complete faith and credit of the US authorities.” In plain English, that means it’s government …