Advantages And Disadvantages Of Knowledge Science

In the financial companies industry, one of the crucial coveted careers is that of the analyst Financial analysts can work in both junior and senior capacities within a firm, and it is a area of interest that often results in different career opportunities. Most financial analysts start in junior positions, working for three to four years and building experience in a specific area or trade. Like an ocean diver, a great financial analyst goes deep into the weeds of finance and market information and brings vital insights to the floor for a company to behave upon.

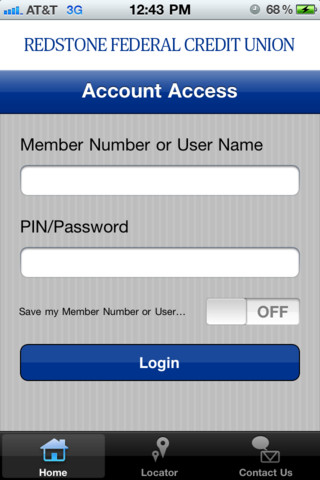

Personal finance advisors help individuals make choices on how one can manage their finances, including mortgages, investments and taxes. So as to do this properly, they should combination a large amount of monetary knowledge whereas also taking in account factors like monetary market developments and past transactions of an analogous nature.![]()

As a result of the position might be quite totally different relying on the place an analyst works — for example an analyst at an investment financial institution can be far more centered on aiding with deals and mergers that one working for an insurance company — the trade an analyst chooses to …