Credit score unions are community-primarily based monetary cooperatives which might be owned and controlled by members who’re also shareholders. Keep in mind that they not solely give better rates on savings accounts however in addition they supply decrease charges on credit cards and loans. When you presently have financial institution loans at a high interest rate, you’re going to get entry to their low curiosity merchandise, in case you join them.

And in gentle of the present monetary crisis, chances are you’ll find yourself among those with good credit experiencing trouble getting a automobile or home loan, the results of tightened lending requirements due to the banking business’s own. As I mentioned before credit unions are smaller branches so their ATM’s will not be as accessible.

Even overdraft fees are usually considerably lower at credit unions. Credit score Unions can do things that bigger Banks can’t. When credit score unions have been first established, they have been cooperatives that helped employees with financial troubles. The same broad designation is apropos of most memberships of most credit unions, regardless of the specific classification, i.e., industrial, church, lecturers, authorities employees, or no matter.

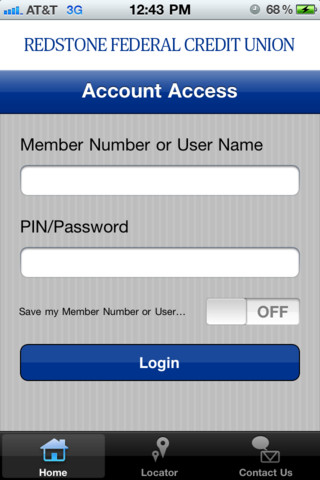

This site tour highlights enhanced features supposed that can assist you share in a better banking experience – on-line. Based on , “Credit score unions have topped the consumer satisfaction ratings in American Banker’s annual survey for 12 years in a row.” Anyone in the U.S. can be a part of a credit union.

Nonetheless as with all monetary institutions, the provided data is assured to be protected by federal regulation in addition to the union’s privateness policy. Originally when credit score unions first began popping up, the shareholders often had something in widespread, like their church, union, office or employer.