Shoppers Credit score Union

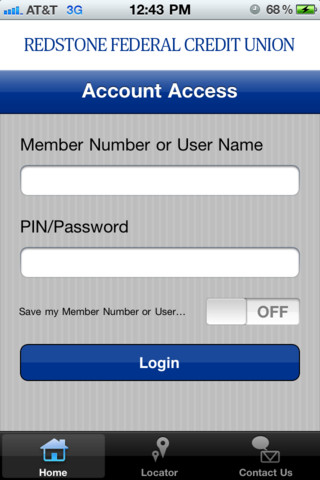

More and more individuals as of late are switching from a big bank to a credit union, and for good cause. Nonetheless, you’ll want to watch out which union you might be approaching since now days some act identical to banks. Unions are additionally similar to banks in the sense that they provide the same companies. If you need to make modifications to your checks (address, phone, and so forth.), please log in to Digital Banking to replace your contact data by clicking the Account Providers icon.

Having a free checking account from a credit score union may also help you save money every year. We’re all about reworking how you expertise monetary companies. Credit Unions are member owned and usually all options are exhausted earlier than collateral is seized.

For the younger youngsters, some credit score unions might supply credit for report cards. Check out Delta Community’s weblog for insightful ideas and information on personal and business banking, monetary planning, making use of for a loan and more. As soon as permitted, you’ll then be capable to choose the suitable financial companies.

The Credit Union Board of Administrators are made up of volunteers or elected members from the group. …